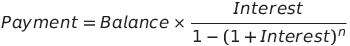

It turns out that calculating the monthly payment is easy. Many spreadsheets and calculators do it for you. The formula is many hundreds of years old and is well known. The formula is:

Payment is the monthly payment; Balance is the remaining balance on the loan (the amount you owe now, not yet crediting this month's payment); Interest is the monthly interest rate (so Interest = annual interest rate / 12; for example 6% is 0.06 / 12 = 0.005); and n is the total number of months for the loan (30 years is 30 x 12 = 360). (1 + Interest)-n means 1 / [ (1 + Interest) times itself n times ].

For our example the monthly payment is:

Payment = $200,000 x 0.005 / (1 - (1 + 0.005)-360 ) = $1,199.10

Recall that for an interest-only loan the cost was $1,000/month. With our 6% loan at the end of the first month we have paid nothing on the loan yet, so now we will pay the bank $1,000 in interest and $199.10 against the principal for a total of $1,199.10.

The bank will receive this payment, take a $1,000 as their "interest" in exchange for lending you $200,000 for one month, and credit your balance $199.10 as the amount you also paid to pay down the principal.

Now in the second month we should pay a little less interest because we no longer owe $200,000. We paid $199.10 against the principal, so now we owe $200,000.00 - $199.10 = $199,800.90.

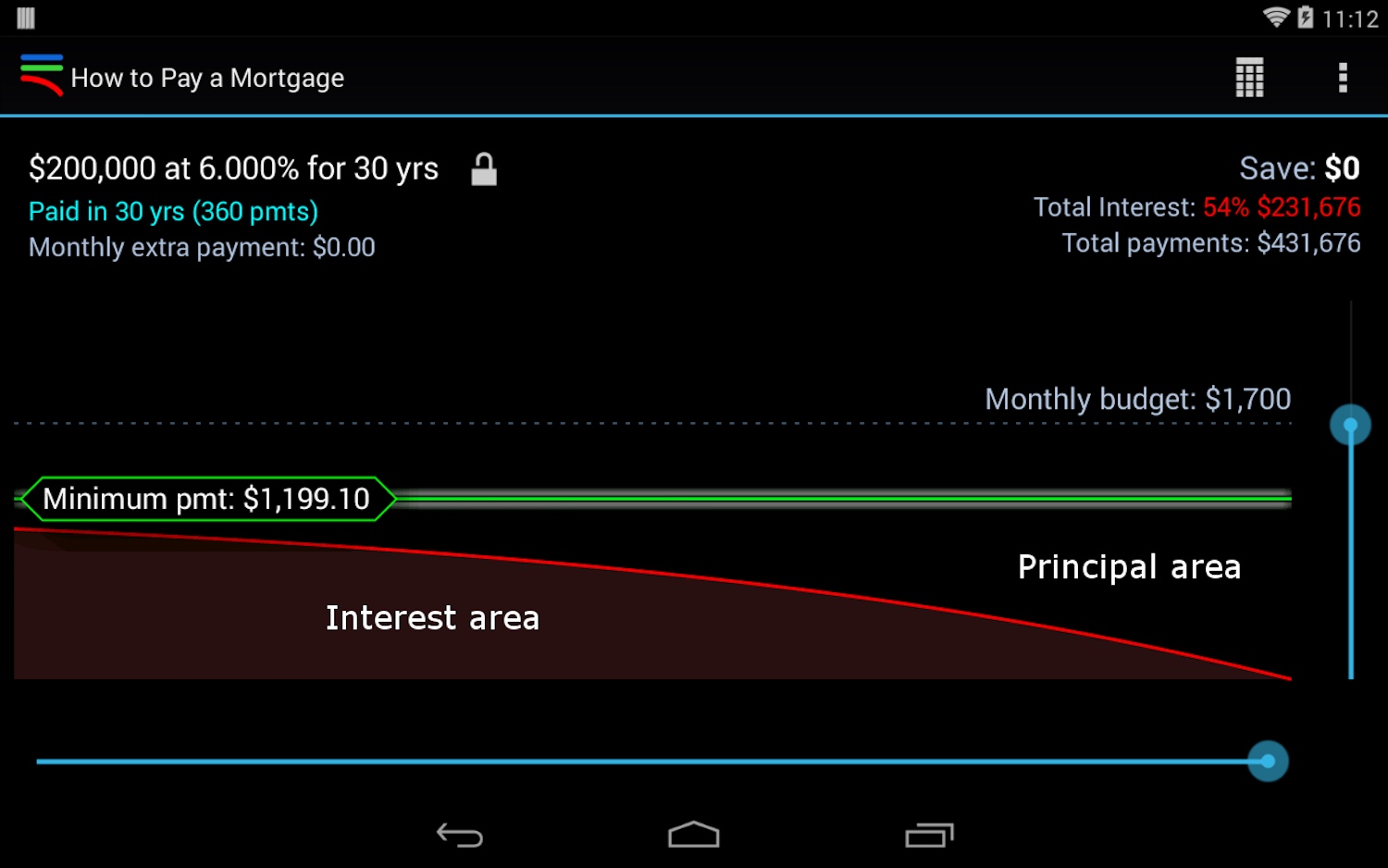

Our monthly payment amount ($1,199.10) never changes, so if we pay less in interest, more of that payment goes to principal. Here’s a graph of showing how fixed monthly payments are split between principal and interest:

From the app How to Pay a Mortgage. Red line is the interest curve. Monthly amounts are available on a separate amortization screen.

We see that in the first few years the principal is paid off slowly because most of the payment goes to interest. Indeed, for the first month we paid $1,199.10 but only $199.10 went to pay down the loan (viewable in the amortization table; not shown). By the second month the amount paid to principal is $200.10—just $1 more than the previous month. The amount paid to principal goes up a little each month, because each month the interest due is calculated on a slightly smaller balance.

What if we just took the total interest due $231,676 and divided it by the total number months 360? We would get the average interest to be paid each month ($644) in a way that we might think is “fair:” just split the total interest due and pay that each month. But we would be wrong.

By the end of the first month we would be pay $644 interest on $200,000. That’s 0.0032 of 200,000, not the agreed upon 6% annual = 0.06 / 12 monthly = 0.005. We are underpaying interest. Of course, the market won’t let us get away with this. Lenders will respond, independently, by raising the annual interest rate until the realized return on lending actually produces what the market will bear for interest on originating loans.

Now let us look at month 360—the last month of the 30 year loan. An interest payment of $644 from a monthly payment of $1,199 implies a principal part of $555. And since this is the last month, this is the entire remaining balance. So we would be paying $644 "interest" on an outstanding balance of $555: that's more than 100% for just one month! We are paying too much interest. So this incorrect model artificially creates pressure to refinance in the later years, because if we re-amortize at the same 6% with a new, shorter loan with another lender near the end of the term we’ll pay less.

Let’s refocus on the correct amortization model to understand why loans are amortized the way they are. Inspection will show that the model retains it’s properties perfectly throughout the entire length of the loan, creating no artificial pressures. For example, if we pay for 1 month, or 360 months, or any month in between, and then calculate a new loan all over again on the remaining principal with the remaining time as the new term, we’ll get exactly the same pay off schedule with exactly the same monthly payment. So there is no inherent pressure for either lender or borrower to change the terms of the loan as the loan is being paid off, all else being equal.

Amortizing correctly, in the first 7 years we pay $20,721.23 against the principal. In those same 7 years, we paid $80,003.26 in interest (an average of $952.42 per month—47% higher than our $644).

Depressing.

The shocker is that 6% interest, which doesn't sound like much, means that over 7 years we will pay 40% of the initial principal ($80,000 / $200.000 = 0.40 or 40%) in interest, and we still owe almost 90% of the loan. Yet there is no magic; it is all available for any one to calculate.

And it is fair—that is, we agreed to pay 6% annually (1/2 of 1% each month) on whatever is owed, and that's what we are doing. Indeed, if we had taken an interest-only loan for those 7 years, we would have paid 0.06 x $200K = $12,000 for each of 7 years, for a total of $84,000.

Now that is a shocker. This really tells us that the difference between 30 years and eternity (the "term" for an interest-only loan) is not that large at the beginning.

The closer your monthly payment is to the interest-only loan, the closer you are to indentured servitude. A monthly payment of $1,199.10 on a 30 year note is quite close to the interest-only amount of $1,000. So a 30 year note—about half of your expected adult life—is an expensive way to own a home.

Thirty-year fixed term mortgages offer many advantages. Not every country offers them (in fact, the U.S. is somewhat unusual in this). They absolutely can help people enter home ownership. And, all else being equal, that's a good thing.

But don't let the fact that "everyone" gets a 30 year loan, and that a 30 year loan allows you to qualify for the biggest house, suggest to you that minimum payments on a 30 year loan is unequivocally good debt for you. A 30 year loan with minimum payments is the closest you may be to indentured servitude while still maintaining a viable business model for the pay back of the principal. A 30 year loan is very expensive—and as we have seen, paying it back early (for example after 7 years) doesn't make it less expensive—in a relative sense, its exorbitantly expensive: you'll pay 40% ($80,000) just to borrow that $200,000 for 7 years.